Deciding how to invest your funds in an uncertain market climate(opens new window) is not easy. Markets, especially fixed income securities, have experienced ongoing volatility since inflation began to surge in early 2022. While it can be disheartening to experience declines in your investments, this shouldn’t necessarily be a reason to delay or alter your approach to investing. In fact, a weak market can allow investors to purchase solid investments at lower prices. Think of it like spotting something you’ve been wanting to buy and noticing that it is now on sale! These periods of market volatility are not unlike a discount at your favorite store.

Dollar-cost-averaging (DCA) can be an effective strategy to successfully navigate investing through uncertain times. The strategy is simple and involves investing small amounts at regular intervals. By gradually entering the market, investors may be able to take advantage of market fluctuations and buy investments at relatively lower prices during market corrections.

Dollar-Cost-Averaging (DCA) in Action

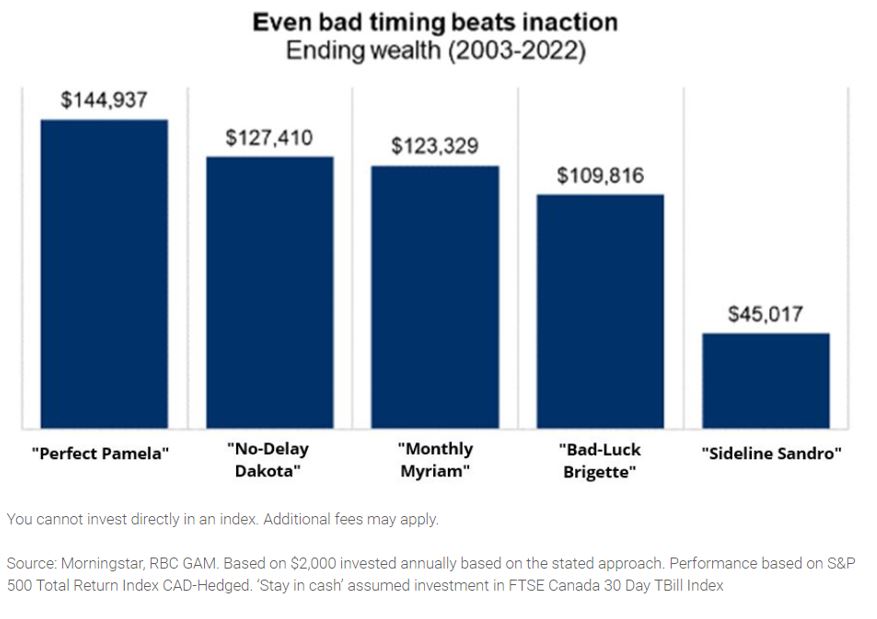

When it comes to investing, our emotions tend to have an impact on our decision making. Determining when or what to invest in purely based on analytics can prove challenging. For this reason, it can be difficult to identify when to invest lump sums of money. For example, not all investors are willing to make a large investment when markets are volatile. It might be appealing to delay the investment until the situation changes. This logic can prevent individuals from investing—sometimes for an extended period. As we have previously examined, the costs of trying to time the market and remaining on the sidelines are steep. Over the long term, even purchasing your investments at the worst time (i.e. during market peaks) can deliver better returns than leaving your funds in a principal protected investment such as a traditional savings account.

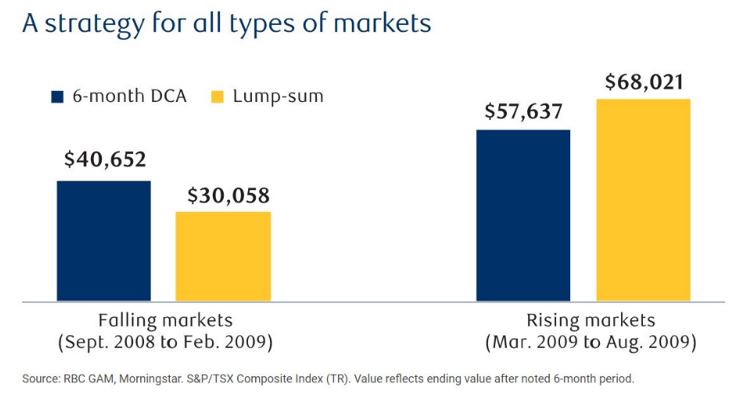

If we turn to prior periods of volatility such as the global financial crisis, we can examine how a DCA strategy compares to investing a lump-sum.

Looking at two six-month periods: one where markets were falling and one where markets were rising, helps us illustrate the difference.

Let’s make a few assumptions:

- Each investor has $50,000 cash to invest

- The DCA investor deployed the cash across six equal monthly installments

- The lump-sum investor deployed the entire sum of the cash on the first day of the same six-month period

During falling markets, the DCA approach protected the investor’s holdings relative to the lump-sum investment.

During rising markets, the lump-sum investor outperformed in the six months following the market trough; however, it is important to recognize that this outperformance relies on perfectly timing the investment to correspond with the market bottom. The reality is that even the most seasoned investment professionals do not have such clairvoyance and only a few investors have access to a significant lump-sum of cash to deploy at the bottom of the market.

With this in mind, a DCA strategy can prove beneficial in that you do not need to attempt to time the market, nor do you need to wait until you have sizeable assets to invest.

Additionally, at RBC InvestEase, our portfolios are diversified and hold stock and bond ETFs which may move in opposite directions. By investing at regular intervals, we are able to take advantage of any short-term fluctuations and purchase stock or bond ETFs based on which asset class is more attractive when we make the purchases.

To make things even easier, you can save on auto-pilot by setting up pre-authorized contributions. By setting up automatic recurring contributions from your bank account, you likely won’t miss those few extra dollars each month, but you could start to see your wealth build up over time. Plus, with RBC InvestEase, there are no trading commissions when we purchase investments which further enhances the benefits of this strategy.

If you want to see how impactful this strategy is, this calculator by RBC Direct Investing(opens new window) effectively highlights the benefits of investing through regular contributions.

To set up pre-authorized contribution from your bank account to RBC InvestEase, simply follow these steps:

- Go to RBC InvestEase(opens new window) and sign into your account

- Select 'Move Money'

- Go to New > Deposit > 'A Bank Account'

- Fill out the form with the details of your new deposit

Investing doesn’t need to be a challenge! With a professional team to look after your portfolio, strategies such as dollar cost averaging and the added convenience of pre-authorized contributions, there are simple steps you can take to get closer to your goals.

If you’d like to chat more about investing tips and strategies, need help setting up pre-authorized contributions, or could use some personalized investing advice, you can reach out to our Portfolio Advisors at questions@rbcinvestease.com or 1-800-769-2531.