Focus on Life While We Focus on Your Investments

Save time and put your money to work with a diversified investment portfolio and a dedicated team to manage it and support you. Simply open your account, make deposits and track your progress online!

Get a diversified ETF portfolio aligned to your goals.

Your portfolio is built with a mix of exchange-traded funds (ETFs) and cash to meet your needs and risk profile—from very conservative to aggressive growth.

Keep your investments on track—without the work.

To help keep your portfolio in line with your goals and the level of risk you’re comfortable with, we monitor your investments daily and adjust as needed.

Benefit from personalized advice when you need it.

Have a question about your portfolio, the markets or something else? Talk to a Portfolio Advisor anytime you want—just send us an email or give us a call.

Our Track Record Says It All…

View the returns that our diversified ETF portfolios have delivered to clients over the years.5

Standard Portfolios

| Portfolio Type | Year to Date | 1 Year | 3 Year | 5 Year | Inception** |

|---|---|---|---|---|---|

| Very Conservative | 7.16% | 7.16% | 1.53% | 3.01% | 3.43% |

| Conservative | 9.87% | 9.87% | 2.92% | 4.62% | 4.77% |

| Balanced | 13.84% | 13.84% | 4.53% | 6.71% | 6.59% |

| Growth | 16.74% | 16.74% | 5.94% | 8.19% | 7.74% |

| Aggressive Growth | 22.96% | 22.96% | 8.81% | 10.96% | 9.88% |

This chart represents annualized returns that do not account for taxes and trading costs.

All returns are gross of fees, hypothetical, and as of December 31, 2024

**Standard Portfolios Inception Date: January 1, 2018.

Responsible Investing Portfolios

| Portfolio | Year to Date | 1 Year | 3 Year | 5 Year | Inception** |

|---|---|---|---|---|---|

| Very Conservative | 7.56% | 7.56% | 1.51% | 2.97% | 3.29% |

| Conservative | 10.50% | 10.50% | 2.88% | 4.61% | 4.91% |

| Balanced | 14.67% | 14.67% | 4.29% | 6.63% | 6.89% |

| Growth | 17.60% | 17.60% | 5.59% | 8.08% | 8.28% |

| Aggressive Growth | 23.23% | 23.23% | 8.11% | 10.74% | 10.83% |

This chart represents annualized returns that do not account for taxes and trading costs.

All returns are gross of fees, hypothetical, and as of December 31, 2024

**Responsible Investing Portfolios Inception Date: April 1, 2019.

Getting Started is Easy

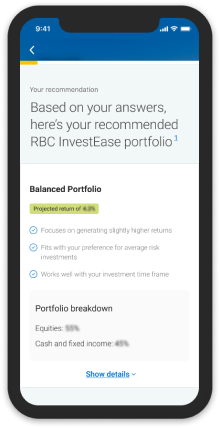

Tell us about yourself. Answer a few simple questions so that we can offer you a portfolio that’s aligned to your investing goals, time frame and feelings about risk.

Choose your account type. You can hold your portfolio in a Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), First Home Savings Account (FHSA) or non-registered account, depending on your needs.

Let Us Keep You on Track. After you’ve opened your account and made your first deposit6, our Portfolio Advisors take care of buying and managing your investments for you, so you can focus on what matters most to you.

FAQs

There is no minimum amount required to open an RBC InvestEase account. We’ll start investing in ETFs once your balance reaches $100 and will invest in a fully diversified portfolio when your balance reaches $1,500.

Your portfolio will be determined by your responses to our online questionnaire, which will ask you about your goals, risk tolerance and investing time frame. It will include cash and ETFs to provide a well-diversified asset mix with fixed income and equities. Each of our portfolios come in two versions—Standard and Responsible Investing.

An ETF trades like a stock on an exchange. Similar to a mutual fund, an ETF lets you hold a variety of investments such as stocks or bonds and access a broad range of assets.

Over time, your investment portfolio may become unbalanced with too much of one asset and too little of another. Our Portfolio Advisors keep you on track by buying or selling the required ETF units to bring you back to your appropriate asset mix.

Open Your First RBC InvestEase Account by April 17, 2025 and Enjoy No Management Fees for 6 MonthsDisclaimer1

Your promo code SA234 will be applied at the next screenDisclaimer2.

Other products and services may be offered by one or more separate corporate entities that are affiliated to RBC InvestEase Inc., including without limitation: Royal Bank of Canada, RBC Direct Investing Inc., RBC Dominion Securities Inc., RBC Global Asset Management Inc., Royal Trust Corporation of Canada and The Royal Trust Company. RBC InvestEase Inc. is a wholly-owned subsidiary of Royal Bank of Canada and uses the business name RBC InvestEase.

The services provided by RBC InvestEase are only available in Canada.